Asx top performers

In this guide. Buy Shares In.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs.

Asx top performers

These high-quality companies are our top picks for investors wanting to boost their domestic exposure. Overall, the Australian share market is fairly valued. Investment success over the long-term means finding great companies that are trading at attractive valuations. When buying shares, it is more than just buying a name on a screen. This approach can help you no matter what your goal or selection criteria is, by helping you look beyond potential noise caused by short-term factors and hype, and find quality shares to invest in long-term. Sign up for a free trial to Morningstar Investor to see all of our top picks. For more information listen to our 3-part series on finding great shares on our podcast Investing Compass. Newmont acquired Australian Newcrest in November The combined company also has material copper production of roughly , metric tons and numerous development projects we think valuable and perhaps overlooked. Gold miners have generally been out of favor due to concerns over rising interest rates, which increases the opportunity cost to hold gold. Recovery from COVID effects, benefits from a more rational mobile market, and cost-outs from the current transformation program are the key drivers, augmented by growth from fixed wireless and the corporate division. Market concerns linger over execution of the current cost-cutting plans and the overhang of major shareholders whose holdings are now out of escrow after the Vodafone merger. However, these concerns are more than reflected in the share price, especially given the longer-term tailwinds for the telecom industry as it transitions to 5G.

Updated Mar 12, Related articles.

.

ASX shareholders. Our Board. Corporate governance. Media centre. ASX rulebooks. ASX Compliance. ASX regulatory framework.

Asx top performers

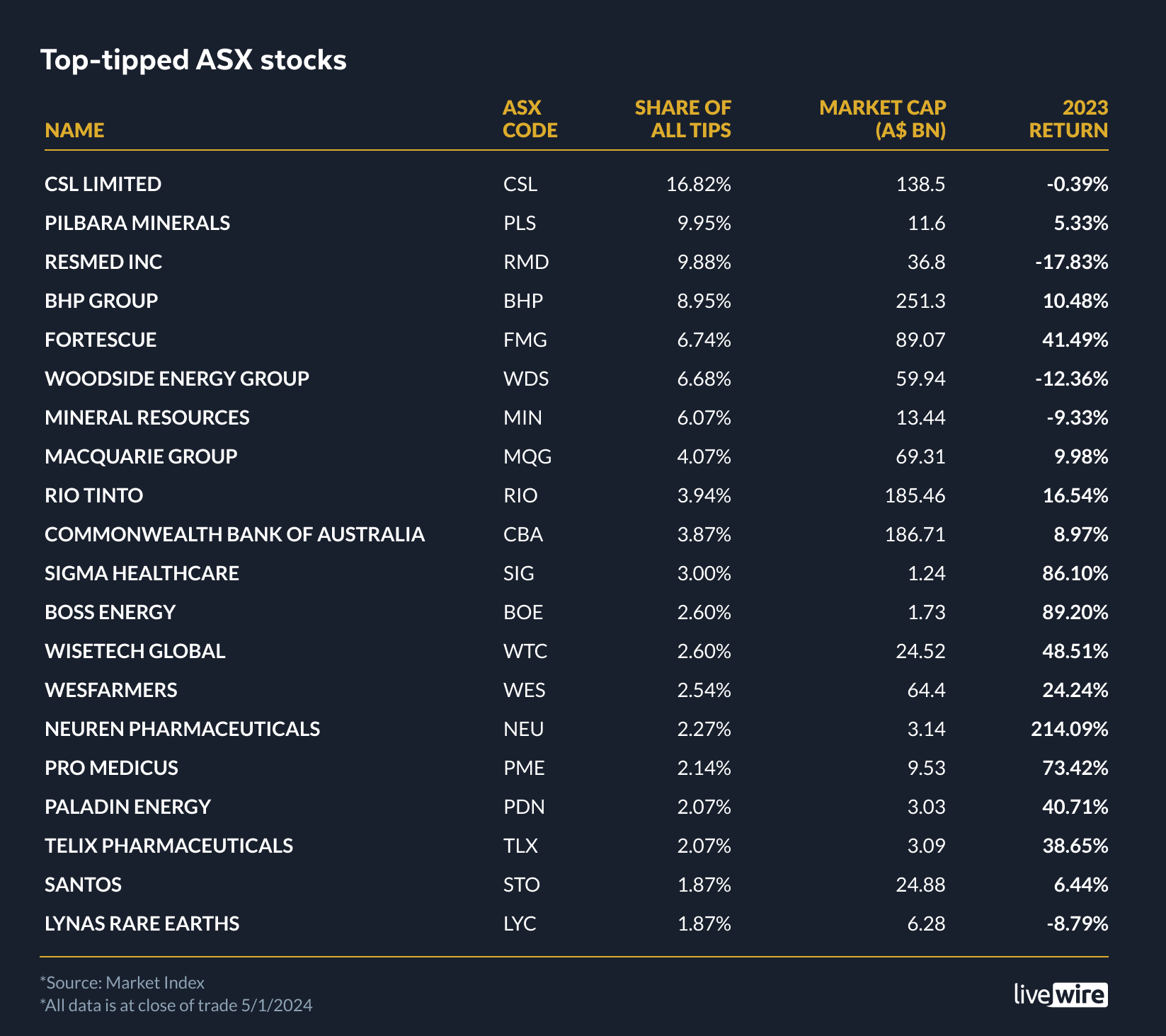

In this guide. Buy Shares In. Invest with. Looking for the best performing stocks in Australia? Before you dive in, it's important to be aware that past performance is no guarantee of future success.

Small couch for bedroom

Where a platform charges different fees for both US and Australian shares we show the lower of the two. Find cheap stock brokerage. Dexus missed out on acquiring some AMP mandates, but we see this as a short-term setback and expect funds management contributions to grow. Newmont Corp NEM. What are the best stocks to own that can pay regular dividends and beat indices on a total return basis in the long-term? Liquor demand is defensive and likely underpinned by inflation and population growth. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. Trade over 45, shares and ETFs from Australia and 15 major global markets. How to invest. CFD service. Buy HGH shares.

.

Upcoming Dividends. However, we think widespread adoption of these drugs will take time given the high cost, limited supply, and side effects. But crude and LNG prices are strong now, and gas has a growing role to fuel the world, including to complement increasing renewable energy production. You can learn more about how we make money. Advertiser Disclosure. Opportunities in the mining sector. Utilities: A total of five industry groups make up the utilities sector. Skip to Content. Buy VUK shares. We ascribe share price weakness to a material decline in sales and earnings from boom-time levels. Past performance is not indicative of future results. Trading CFDs and forex on leverage comes with a higher risk of losing money rapidly. Your financial situation is unique and the products and services we review may not be right for your circumstances.

0 thoughts on “Asx top performers”