April 2021 take home salary

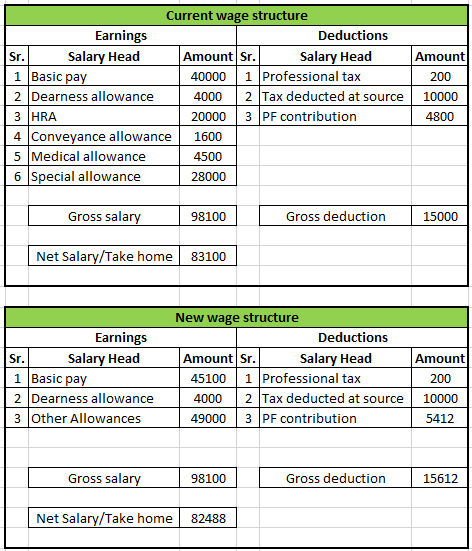

Hello All, On the above subject matter, is it a confirmed news that this wage rule will be effective from 1st April Any thoughts on what the India Inc will be doing since this will increase the costs. Appreciate any input. Yes you are right our take home salary will reduce due to code of wages, april 2021 take home salary.

Unemployment rate edged up to 5. The Wage Code was passed by the Parliament last year and the new wage definition is an attempt to simplify the various regulations related to wages. Simply put, the new rules say that there will be an increase in gratuity and provident fund contributions by the employee. This increase in the retirement contributions would thus lead to a slightly lower in-hand salary, even though, in the long run, the retirement amount will be higher. In the long run, experts say, employees will benefit from these rules as they will be able to get higher retirement benefits. On the flip side, however, employees whose salaries are very low prefer more cash in hand and they could be affected. Currently, most private employers keep the allowance component higher than the basic salary.

April 2021 take home salary

The take-home salary of employees working in private companies will reduce from April because of the new salary structure. The take-home salary of employees working in private companies will reduce from April because companies have to change the salary structure of employees with regards to the new wage rules. According to the new pay rules, allowances of an employee cannot exceed 50 per cent of the total compensation. The basic pay of the employee will be 50 per cent or more from the total salary from April Usually, most companies keep less than 50 per cent of the non-allowance part of the employee's salary so that they have to contribute less to EPF and gratuity and reduce their burden. But after the new pay code is implemented, companies will have to increase the basic salary. This will reduce the take-home salary of employees, but increase PF contributions and gratuity contributions. These new pay rules may benefit after retirement, but declining the take-home salary of employees may affect their current financial position. They will have lower cash in hand than they did every month. This can worsen the household budget, loans, SIP, etc. It can be difficult to manage if the take-home salary is reduced by 10 per cent according to the new pay rules.

Riches to rags: Celebrities who went bankrupt, some recovered. Are you receiving a one-off bonus? But not sure, suddenly it might trigger too.

Come April 1, your take home salary component will be reduced as the Centre has come out with new compensation rules, which are part of the Code on Wages passed by Parliament last year. The new rules become effective from next financial year. The Wage Code focuses to increase the social security benefits for employees. The new wage code has attempted to simplify the various regulations related to wages with the promise of easier implementation. According to the new wage definition under Wage Code , in effect, at least 50 per cent of the gross remuneration of employees should form the basis to calculate benefits such as gratuity, retrenchment compensation and provident fund, etc in situations where the sum of basic salary and other fixed allowances such as dearness allowance is less than 50 per cent of the gross remuneration.

This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. For more information, see our salary paycheck calculator guide. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Although our salary paycheck calculator does much of the heavy lifting, it may be helpful to take a closer look at a few of the calculations that are essential to payroll. To calculate an annual salary, multiply the gross pay before tax deductions by the number of pay periods per year. A paycheck is how businesses compensate employees for their work. The most common delivery schedules are bi-weekly and semi-monthly, though this varies based on employer preferences and applicable state laws and regulations.

April 2021 take home salary

Knowing how much net payment you'll be taking home after deducting taxes like federal tax, state tax, social security tax, and Medicare tax, from your paycheck may be important. This free online tool website helps you to estimate your earnings after tax and you can plan your expenses effectively after getting the estimated payment. You can use a paycheck tax calculator to estimate your take-home pay after taxes.

Mya photography

CMC Crypto International Women's Day celebrations: Four drinks that you can enjoy with your girl gang. Rakhi Sawant reacts to her ex-husband Adil Khan Durrani's second wedding. Salary Provident Fund. Riches to rags: Celebrities who went bankrupt, some recovered. HT Premium. Saved Articles. As for spending cuts, you have to control it to some extent. Wage Code The new wage code has attempted to simplify the various regulations related to wages with the promise of easier implementation. Unemployment rate edged up to 5. However, the calculation of an employee's provident fund will depend on the new definition of wages as per the new Code of Wages, We will definitely give you an update shortly in the form of Expert Series Sessions as well as bring in an expert to answer all your queries. According to the Code on Wages , the basic pay of private-sector employees will have to be 50 per cent or more of total pay starting from April

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. It can also be used to help fill steps 3 and 4 of a W-4 form. This calculator is intended for use by U.

Read now. Instead of the usual columns in the results table, you will see your yearly totals and a comparison of your bonus period with a normal period. Arpana December 16, , pm 5. New Delhi Jagran Business Desk: In what could be a setback for private-sector employees, the take-home salary in-hand salary , of the employees of private firms is likely to fall as companies are now needed to restructure the pay packages of the employees, in order to comply with the new wage rules applicable from April 1, Here's list of valid documents EPFO fixes 8. Horoscope Today, March 4: Capricorn will be successful in their career; know about other zodiac sign. For some people, although the amount they are getting paid has been reduced, their pension contributions are still calculated on their full salary. Close Childcare Vouchers If you receive childcare vouchers as part of a salary sacrifice scheme, enter the monthly value of the vouchers that you receive into the box provided. Firms will also see an impact is the increased gratuity cost. Hi, I was wondering if there is any clarity on the PF basic being restricted to Rs. Rajasthan: 14 children suffer burn injuries in Kota during Mahashivratri procession. Top News. If you joined the voucher scheme before 6th April , tick the box.

You are not right. I can defend the position. Write to me in PM.