Altcoin season index

The altcoin season index is a tool that tracks how Bitcoin performs in comparison to the top 50 altcoins by market capitalization over 90 days.

When you read or learn about the crypto market movement, there is one term that describes the dominance of the crypto market, altcoin season. What exactly is altcoin season? Altcoin season is a market condition where the price movement of most alternative cryptocurrencies altcoins rises rapidly compared to Bitcoin within a certain period. During an altcoin season, investors and traders may shift their focus away from Bitcoin and begin buying and trading altcoins to earn profits. This can cause the prices of altcoins to rise rapidly, sometimes by significant percentages in a short period. An altcoin season is like a shopping spree for cryptocurrencies other than Bitcoin.

Altcoin season index

Altcoins can be interpreted as alternative coins. These are all cryptocurrencies except for Bitcoin, and when their season comes - altseason , many of them can grow by hundreds and even thousands of percent. In this article, we will figure out. What types of altcoins exist? What to pay attention to when buying altcoins? What is "altseason" and how to determine its onset? Altseason is largely a psychological phenomenon. We recommend reading this amazing trader psychology spin-off in your free time. But for now, let's delve into altseason and altcoins. Altcoins are all coins except for Bitcoin. Historically, BTC was the first to appear on the market, and other coins followed, hence the name "alternative". Technically, the entire industry is based on Bitcoin: if it falls, usually altcoins fall with it. Bitcoin is a measure of market stability, and the average temperature in the crypto industry depends on its fluctuations. The first altcoin in the history of the industry was Namecoin

In April-Julyaltcoin season index, the alt-season index often reached and held at that mark Conclusion Alt season is a market condition when altcoins show rapid growth. Traders use the altcoin season index to predict when the altcoin season starts. Bitcoin has a high market capitalization, making it challenging to yield high percentage returns, unlike most altcoins with low market capitalization.

.

The cryptocurrency market is known for its volatility and ever-changing dynamics. Within this market, altcoins , or alternative cryptocurrencies to Bitcoin, play a significant role in shaping investor sentiment and market trends. Understanding when altcoin seasons occur and how to identify them can be crucial for investors and traders looking to maximize their profits. The Altcoin Season Index ASI is a metric designed to gauge the overall sentiment and activity levels of altcoins within the cryptocurrency market. It provides a quantitative assessment of altcoin market conditions, helping investors and traders identify periods when altcoins are experiencing increased activity and outperforming Bitcoin. The ASI takes into account several key factors to determine the strength of altcoin seasons.

Altcoin season index

The altcoin season index is a tool that tracks how Bitcoin performs in comparison to the top 50 altcoins by market capitalization over 90 days. The day window reduces short-term fluctuations and provides a long-term market view. The performance of these top 50 Altcoins excludes stablecoins and asset-backed tokens like wrapped BTC. Traders use the altcoin season index to predict when the altcoin season starts. It can be challenging for traders to monitor the performance and market capitalization of each altcoin, hence the need for the index.

Obis gelişim

The altcoin season index can be helpful during bearish or bullish market cycles. This development signifies a broadening of the market's appeal, attracting even conservative investors who prefer the traditional route of investing through ETFs available on brokerage apps, steering clear of the complexities of crypto exchanges and wallets. The mining sector has faced a crunch, being unprofitable or marginally profitable for over eighteen months. One good signal is if the altcoin has an active team of builders improving the protocol. OTC Trading. Triggers for the Altcoin Season Index Traders may not always identify when the altcoin season begins because it can be unpredictable. This analysis stems from a comprehensive review of multiple sources, offering a forward-looking perspective on cryptocurrency dynamics. Altcoin season index: how it's calculated and what it means The altcoin season index is perhaps the simplest way to find out if we are experiencing a season of alternative coins or not. Here is what Bitcoin dominance has looked like from to today: As seen on the graph, Bitcoin started losing its position sharply from Because cryptocurrencies have high volatility, altcoin prices can change at any time. However, play is a complex and layered phenomenon, extending far beyond mere chips and roulette. Two notable triggers are market sentiment and technological advancement. An altcoin season is like a shopping spree for cryptocurrencies other than Bitcoin.

.

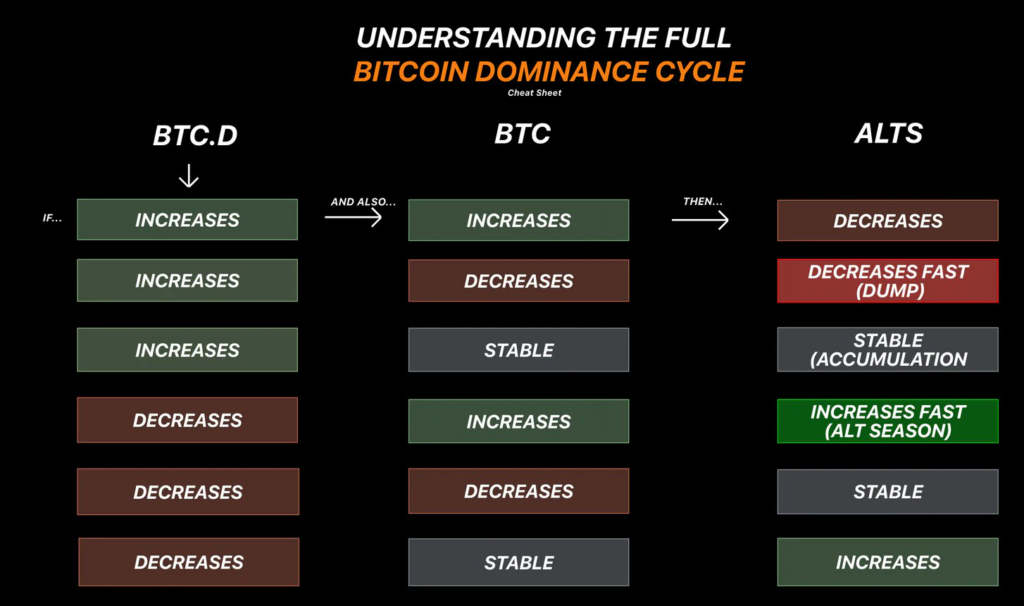

As seen on the graph, Bitcoin started losing its position sharply from Many things drive the altcoin season. The increased volatility can be a double-edged sword. Replies Historically, Bitcoin's peak prices have been roughly double the mining cost. This innate inclination towards play is embedded in our nature: animal cubs play, children engage in play, and adults Bitcoin remains dominant due to its considerable measure of stability in price volatility. The reason for alt season is that capital flows from Bitcoin to altcoins when investors try to lock in profits. Additionally, the high cost of purchasing Bitcoin can cause potential buyers to buy altcoins. An uptrend tells traders to stack more altcoins, while a downtrend tells traders to tilt toward Bitcoin or stablecoins.

In my opinion you are not right. I can defend the position. Write to me in PM, we will discuss.

Bravo, this brilliant phrase is necessary just by the way