Alice blue automated trading

Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.

Algo Trading is nothing but a computer program that follows a particular trading strategy that places buy and sell orders. These orders are placed at a speed that cannot be matched by any human being. What is Algo Trading? It is nothing but a computer program that follows a particular trading strategy and places buy and sell orders. There are companies that provide ready-made Algo strategies or help you in coding your own strategies.

Alice blue automated trading

Open Instant Account online with Alice Blue and start trading today. It alsofacilitates the integration of your trading platform with third-party tools like MT4, Amibroker, or website to get data and punch orders. Alice Blue APIs provide a confidential key that helps traders establish a connection between their algorithm and Alice Blue's trading platform to obtain real-time market data and live market order placements. Alice Blue API is available free of cost. Alice Blue does not provide historical data API. ANT Plus API gives users programmatic access to the trading platform of Alice Blue that helps faster trade execution, multiple order placement, managing user portfolio, live market feeds, and much more. Alice Blue Interactive APIs are the trading APIs that help to place, modify, and cancel trading orders of different types like regular orders, after-market orders, basket orders, and bracket orders. Alice Blue API can help users with algorithmic trading. Using Alice Blue API, you can convert your trading ideas into trading strategies and build your own algorithmic trading system for systematic trading using Alice Algo. The WebSocket API allows you to receive market data for multiple instruments across exchanges in the live market. You can either get the Compact or Full Market snapshot as desired. Alice Blue API makes trading easy and convenient for traders. Alice Blue Algo trading helps speedy order placement, which is very important for trading considering the dynamic markets that change every millisecond. For example, you decide to buy Nifty when it is trading at

You need to drop an email to api aliceblueindia.

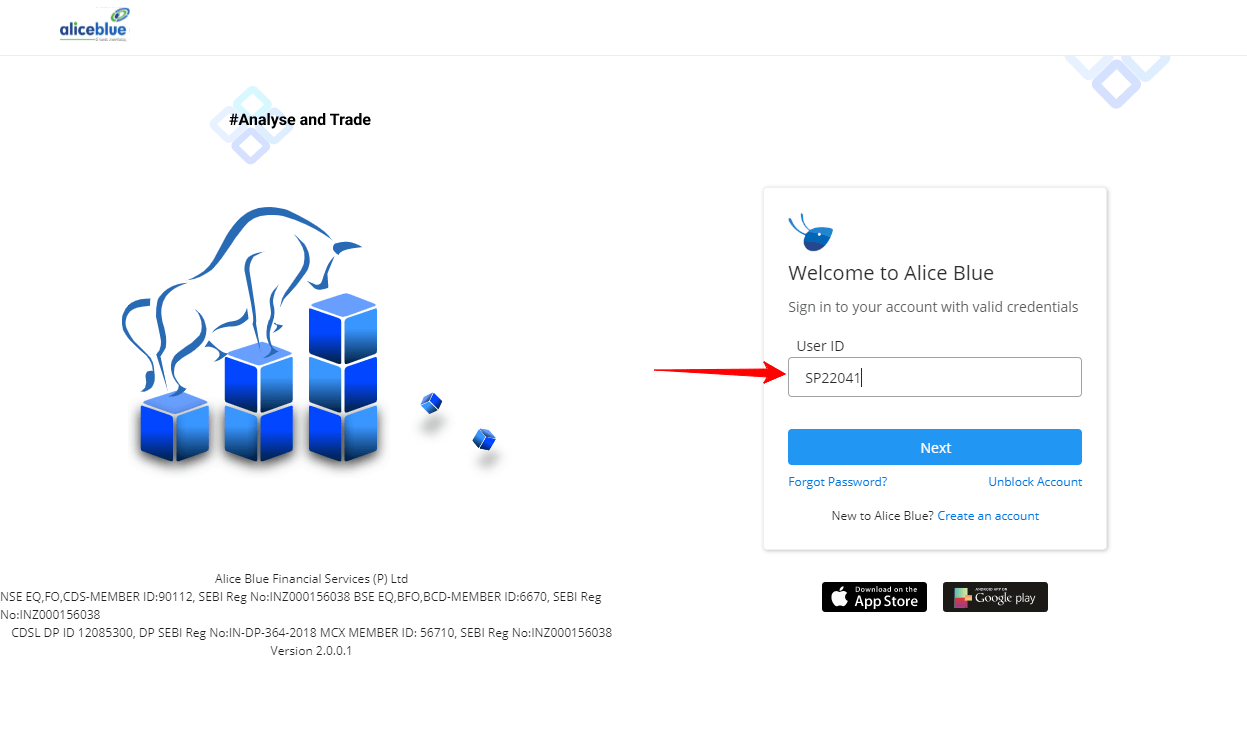

Execute orders in real-time, manage user portfolios, stream live market data using Websocket , and more, with the easy-to-understand API collection. You can use a redirect URL which will be called after the login flow. It is highly recommended that you do not include the apiSecret in your code while sharing in public places like GitHub. It will make your app vulnerable to threats and potential issues. In this article, We shall discuss How to create an app in the Developer Console. Step 1: Head over to the Developer Console. Use Your credentials to login there.

Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w. September 1, Corporate Office: No. Registered Office: Old No. Benefits: Effective Communication, Speedy redressal of the grievances.

Alice blue automated trading

Open Instant Account online with Alice Blue and start trading today. It alsofacilitates the integration of your trading platform with third-party tools like MT4, Amibroker, or website to get data and punch orders. Alice Blue APIs provide a confidential key that helps traders establish a connection between their algorithm and Alice Blue's trading platform to obtain real-time market data and live market order placements. Alice Blue API is available free of cost.

Matt rife tour seatgeek

What Is Algo Trading? Best avoided by anyone serious about developing and deploying an algo strategy through a broker API. These programs basically uses 3min low , 6min medium time frame supertrend and RSI indicators adjusted through parameters to generate signals. So in this strategy, the algorithm places a buy order when the stocks hit an unusually low price level and place a sell order when the stock hits an unusually high price assuming that the stock will revert back to the average price. Leave a Reply Cancel reply Your email address will not be published. Algo trading, or algorithmic trading, is a method of executing orders using automated pre-programmed trading instructions considering variables such as time, price, and volume. View all files. It is a retention order type that is used to fix the time duration of the order. You signed in with another tab or window. Best Large And Midcap Fund. These orders are placed at a speed that cannot be matched by any human being. Step 5: As You can see in the image below there are several fields. Vinayak aims to empower newbies with relatable, easy-to-understand content. It alsofacilitates the integration of your trading platform with third-party tools like MT4, Amibroker, or website to get data and punch orders.

.

What is Trading Account. The benefits of Algo trading are that orders will be placed instantly at accurate prices without the chance of any human errors. Alice Blue does not provide historical data API. Registered Office: Old No. Benefits: Effective Communication, Speedy redressal of the grievances Click on the provided link to learn about the process for submitting a complaint on the ODR platform for resolving investor grievances. Mutual Fund Redemption. It will help me improve. September 1, Can algo trading be profitable? Alice Blue Special Offer. For queries regarding account opening or activation, email to [email protected] and for fund updates, email to [email protected]. Hence, you are requested to use following USCNB accounts only for the purpose of dealings in your trading account with us. Using these APIs, users can build their customized trading platform as per their requirements.

It does not disturb me.