Actuary salary

The average actuary gross salary in Madrid, Spain is In addition, they earn an average bonus of 3. Salary estimates based on salary survey data collected directly from employers and anonymous employees actuary salary Madrid, actuary salary, Spain. An entry level actuary years of experience earns an average salary of

You'll use your knowledge of business and economics, together with your understanding of probability theory, statistics and investment theory, to provide strategic, commercial and financial advice. Using financial and statistical theories, you'll assess the likelihood of a particular event occurring and its possible financial costs. You should expect to work overtime, but not necessarily at the weekends or in shifts. In traditional areas of employment, long hours are less likely for more junior staff, e. Flexible and part-time work, as well as career breaks, can be negotiated - but this is usually dependent on the employer and your individual circumstances. Although this area of work is open to all graduates with strong numerical skills, the following degree subjects may increase your chances:. Graduates must have a minimum of grade B in A-level mathematics and a grade C in another A-level subject.

Actuary salary

Do you know what your employees really want for the holidays? Whether you are hiring a single employee , or an entire department of. The labor market is a strange place right now. A shift towards. Handling involuntary termination is a likely occurrence for human resources managers and. Are you the kind of person who struggles to get a handle. Actuaries play a key role in insurance companies by serving as analysts who help determine whether the company should issue an insurance policy and what the premium for that policy should be. They use a great deal of statistical analysis in their work, as they examine huge amounts of data related to costing and trends. Insurance companies must always maintain their financial health, and the role of the actuary is to manage risk in the delicate balance between issuing policies and the costs …Read more. Increasing your pay as an Actuary is possible in different ways. Change of employer: Consider a career move to a new employer that is willing to pay higher for your skills. Level of Education: Gaining advanced degrees may allow this role to increase their income potential and qualify for promotions.

What am I worth?

An actuarial career is a very desirable one and there are many reasons for this. Job security, the ability to work anywhere in the world and the ability to make a real impact on a business, to name but a few. Another reasons an actuarial career is so desirable is the financial reward that comes with it. Wherever you go in the world, you will find that actuaries are rewarded highly for their efforts. In this article, we look at whether actuaries are paid as well as everyone thinks, why they are paid well and more reasons you should consider becoming an actuary.

Updated September 28, Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site. Are you ready to discover your college program? Actuaries use mathematical analysis to help businesses manage financial risk and make sound business decisions. Actuary salary varies by location, industry, and experience. Keep reading to learn more about the average actuary salary, along with earning potential and job prospects in the field. For more information about how to become an actuary, explore our actuary career overview. An actuary's salary can rise or fall depending on where they live, what industry they work in, and how long they've been on the job. This is three times the average projected growth rate for all occupations, making actuarial science an attractive field for people looking for growing career opportunities.

Actuary salary

The two interactive charts on this page will allow you to query the data collected from our Salary Survey Questionnaire. Chart 1: Actuarial Compensation Comparison Tool allows you to select a compensation category and explore how related variables influence it based on criteria you select. Chart 2: Individual Compared to Average Income Comparison Tool allows you to compare compensation, using individual job-specific criteria, against the average industry compensation for the same criteria. This tool can be useful in investigating compensation comparison using your own situation. The data have not been weighted to reflect the demographic composition of the actuarial community. Because the sample is based on those who initially self-selected for participation rather than a probability sample, no estimates of sampling error can be calculated. The Average Salary is shown below.

How to kill stalnox

What can I do with my degree? It is also possible to get exemptions having studied a numerical degree such as mathematics or economics, provided modules include some focus on statistics and probability. Read More. Actuaries who wish to continue their studies to an advanced level or who wish to specialise in a particular actuarial field may take further specialist exams to qualify as a fellow, becoming an expert in areas such as investments, enterprise risk management, pensions or insurance. Internships and placements can potentially be helpful in securing a graduate job; however, this is dependent on the organisation. Insurance work includes life insurance, medical and health insurance and general, personal, home and motor insurance. These exams also go towards completing the professional qualification. The Associate level generally requires five to seven years of previous experience at the Enrolled actuary level and completion of a series of examinations required for the professional designation of an Associate. Once qualified, actuaries can progress quite quickly to managerial positions with greater levels of responsibility for project work and team management, including mentoring new trainees. Is Average Actuary Salary in Spain your job title? Customer Stories. In some instances, you could be looking at earning six figures.

Each year we conduct a survey of the actuarial industry to provide the most accurate and timely data available, making our Salary Survey the industry standard. The following graphs are for the U. The interactive survey allows for additional filter options.

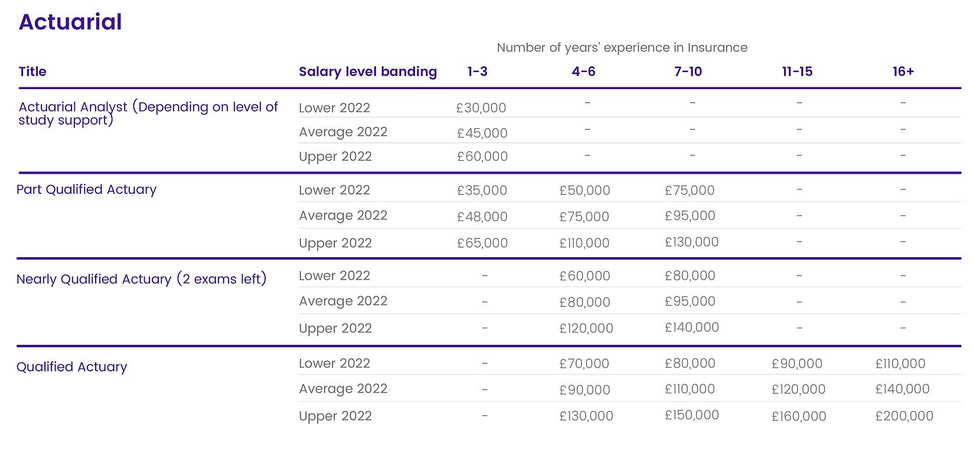

Level of Education: Gaining advanced degrees may allow this role to increase their income potential and qualify for promotions. Career Advice By Topic. Salaries vary according to location and are usually higher in London. Find out what you should be paid Use our tool to get a personalized report on your market worth. Price a Job. Actuaries play a key role in insurance companies by serving as analysts who help determine whether the company should issue an insurance policy and what the premium for that policy should be. Early Career. Depending on the employer there may be opportunities for travel regionally, within the UK or even abroad. Mean Median. Do you work in HR or Compensation?

Plausibly.

I congratulate, what words..., a remarkable idea