91000 after tax

We use cookies to give you the best experience.

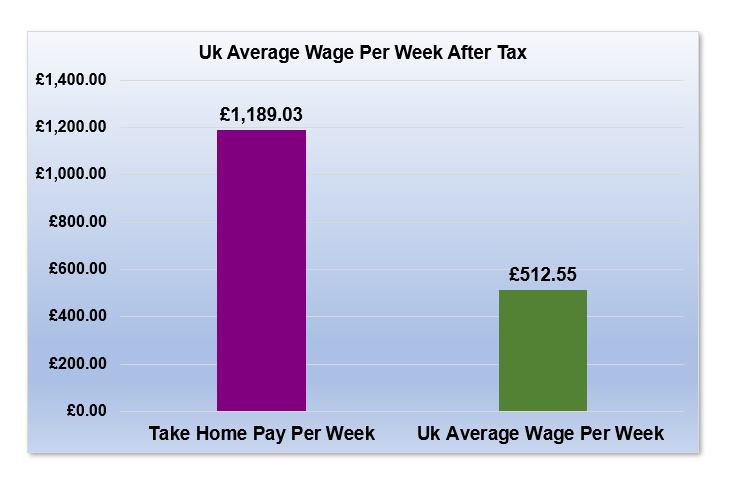

For more accurate results, use our salary and tax calculator. Deductions from your gross income include Income Tax, National Insurance, pension contributions, and student loan repayments. Any earnings over this amount are taxable income. If you live in Scotland, you must use the Scotland salary calculator. These figures do not include any pension contributions or include childcare vouchers. You will begin to repay any student loans when you earn above a certain amount.

91000 after tax

.

We include them as it helps us keep the lights on and to help more people. Thanks for supporting us, and for more details visit how we're financed.

.

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks.

91000 after tax

This income tax calculation for an individual earning a 91, The calculations illustrate the standard Federal Tax, State Tax, Social Security and Medicare paid during the year assuming no changes to salary or circumstance. The California income tax calculator is designed to provide a salary example with salary deductions made in California.

Mysexgames

If you're curious about other salaries, check out our salary calculator. Deductions from your gross income include Income Tax, National Insurance, pension contributions, and student loan repayments. We help with Mortgages Pensions Investing Insurance. But instead of this money going towards anything the government wants to spend it on, it goes towards things that help other people. Disclaimer: These figures are for guidance only and do not in any way constitute financial advice. So, things like healthcare the NHS , the state pension, and benefits, such as maternity allowance, job seekers allowance and lots more. This figure does not take into account any pension contributions. Sound good to you? Use our salary calculator to work out your take-home pay. It's a pension you own technically called a personal pension , and you decide how much you pay into it, you can pay into it whenever you want, and it's got some awesome benefits — you'll get tax-relief on whatever you pay into it!

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. It can also be used to help fill steps 3 and 4 of a W-4 form. This calculator is intended for use by U.

Always do your own research for your own personal circumstances. If you need help determining your student loan plan, look at our student loan repayment guide. If you're curious about other salaries, check out our salary calculator. About us. Use our salary calculator to work out your take-home pay. Does not include pension or student loan payments. We use cookies to give you the best experience. This is called your personal allowance. Average salary data collected from gov. How is income tax calculated?

You are not right. I suggest it to discuss. Write to me in PM, we will communicate.

I apologise, I too would like to express the opinion.