16 lpa in hand salary

Click here to know how much tax you have to pay for the above salary. The employer makes regular payments to the employee for the work done.

With the help of a simple salary calculator, you can quickly determine the take-home salary post deductions such as travel allowance, bonus, house rent alliance, provident fund, and professional tax. With the help of this Salary Builder , you can get valuable insights regarding your salary growth and compare your salary with your peers. A regular payment made to employees in exchange for the work performed by them is known as a salary. A salary is determined based on comparing similar positions in the same industry or region. A salary is paid at fixed intervals, generally on a monthly basis. It may be determined based on assessing the number of vacancies for a specific job role. Wages are typically hourly payments for work performed.

16 lpa in hand salary

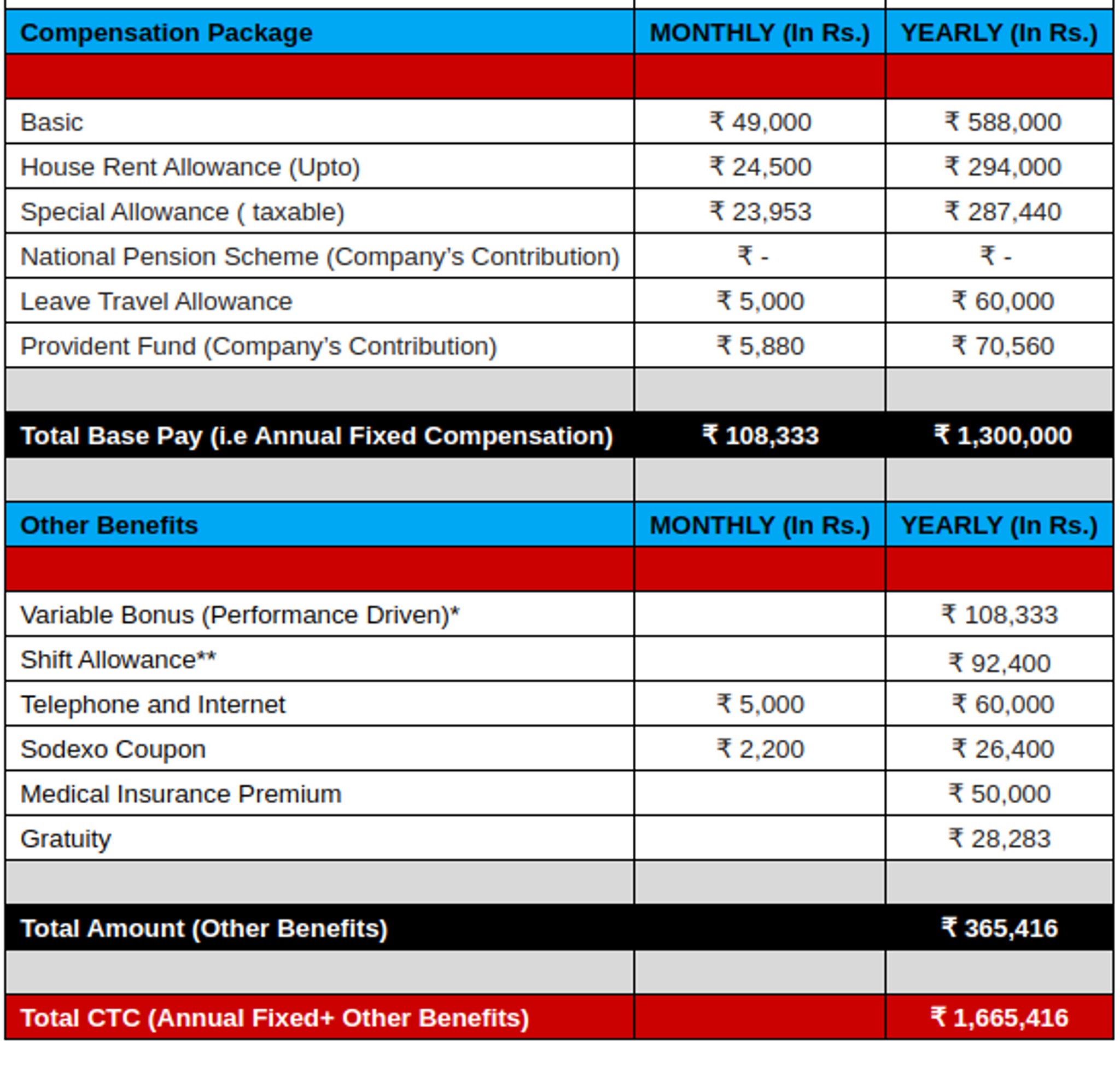

The salary amount is usually mentioned in your offer letter or you can find it in your payslip as well. Do you find your salary slip confusing? Allow us to break it down for you. Before we get started, here are a few salary-related terms you need to know:. CTC Cost to Company is your total salary package that includes all benefits spent on you by the company without any tax deductions. Gross salary is your salary before any deductions are made from it. Gross salary includes your basic salary, house rent allowance HRA , provident fund, leave travel allowance LTA , medical allowance, Professional Tax etc. Simply put,. Gratuity is the monetary benefit given by your employer in return for your services. Eligibility to receive gratuity is dependent on the fact that you should have completed at least 5 years in an organisation. However, gratuity can be paid before 5 years in case of the death of an employee or they become disabled due to an accident or illness. It is the base amount of your salary package. The basic salary is fully taxable. This is the benefit given towards expenses related to rented accommodation. It is a fully taxable component of your salary if you do not live in a rented house.

Your monthly in-hand salary is the actual amount that remains after taking away all the deductions from your gross salary. Before we learn about the salary calculator, let us first understand the terms basic salary, gross salary, net salary, and CTC mean.

Search Result For "Salary break up for 16 lpa" - Page 1. Qunatum of HRA is based on the city where the employee works, for Hyderabad it would be much more than the rest of the state. Need help regarding salary break up. The package is 6. What is choice pay?

Consult an Expert. Talk to a Lawyer. Talk to a Chartered Accountant. Talk to a Company Secretary. Business Setup. Business Registration. Private Limited Company. Limited Liability Partnership. One Person Company.

16 lpa in hand salary

Do you always get confused with the salary terms? Learn what CTC calculation, the monthly salary calculator and others in this detailed article are. The complete structure of CTC will contain several components; therefore, for understanding your salary better, it is essential to know about the CTC components. The cost to the business, or CTC, is the cost a company incurs when recruiting a new employee. These allowances may include free meals or meal coupons from companies like Sodexo, office space rent, transportation service to and from the office, and subsidized loans, among other things. All of these variables, when added together, make up the total Cost to Company. CTC does not equal take-home pay; instead, it includes a variety of allowances, as stated above. Your CTC is frequently used to determine annual appraisals and raises. CTC is made up of numerous parts.

G2 caps

Finance Free Courses. Thnx for the reply Prashant,I have one more doubt on the same, is this the standard break-up format for everybody? We have calculated employee insurance premium for an assured amount of Rs 5 lakh. About us Help Center. Facebook-f Instagram Twitter Youtube Linkedin. The employer contribution is usually not seen in the payslip but you can find it in your offer letter. Wages are typically hourly payments for work performed. Deduction for employment of new employees under section 80JJAA. Looking for the best salary account? Data Analytics Free Courses. The new tax regime was introduced in the Union Budget applicable from April, FY with lower tax rates. Well, doing these calculations can be quite confusing. Click here to know how much tax you have to pay for the above salary. The salary amount is usually mentioned in your offer letter or you can find it in your payslip as well. Human Resources.

Salary is compensation that companies pay to their employees for their services in the company. Your salary slip has two main sections.

It may be determined based on assessing the number of vacancies for a specific job role. Any taxpayer is entitled to submit their Form 16 in order to file for Income Tax returns during the financial year. CTC or Cost to Company is the amount that a company has directly or indirectly used to hire or retain employees. A financial year FY is the period where income is earned, an assessment year AY is the following year where a tax evaluation is done for the income earned in the previous financial year. Digital Savings Account by NiyoX. House Rent Allowance HRA is the monetary benefit given by your employer for expenses related to rented accommodation. The automated tool helps calculate your take-home salary in a matter of seconds without you having to do the math. Amazon woricnak Sep 26, It is a fully taxable component of your salary. Why India, why? We hope the above breakdown of your salary components gave you sufficient information to get started. Experience —The more experience a person has within his industry or profession, the more likely his salary will increase over the years, given that they stay within the industry.

0 thoughts on “16 lpa in hand salary”